CASE STUDY: JMP042

US Stock Indices

by M Ajoy Kumar, Associate Professor, Siddaganga Institute of Technology

Muralidhara A, JMP Global Academic Team

Key Concepts: Differencing, log transformation, stationarity, Augmented Dickey Fuller (ADF) test

Objective

Understand the basic concepts related to time series data analysis and explore the ways to practically understand the risks and rate of return related to the financial indices data.

Background

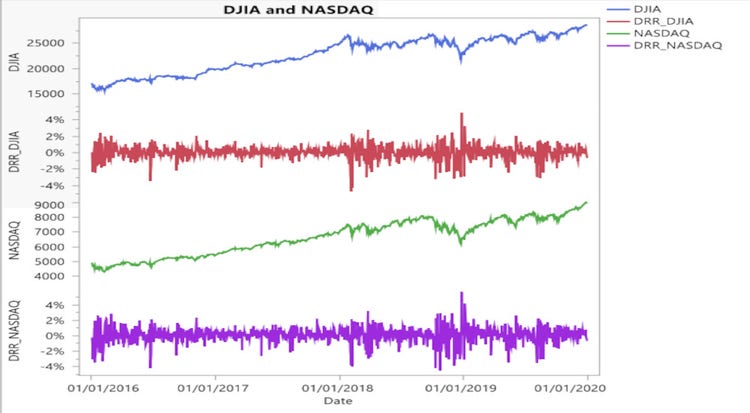

After completing graduation degree in Finance, James joined a leading Investment Advisory firm in New York as intern. He was reporting to Sarah, a Senior Analyst at the firm. James was involved in a research project on US Stock Markets. As the first assignment Sarah wanted James to analyse the performance of US Stock Markets during 2016-2019. The specific tasks given to James included analysing the rates of returns and risks of four major markets and comparing their performances. Since Sarah wanted to use this data for further analysis and forecasting, she wanted James to also analyse the stationarity of the indices of the markets.

The Task

James needs to analyse the performance of stock market for the financial indicators computed for four indices. He must derive the following metrices.

- Daily rates of returns

- Risk measured as standard deviation of daily returns

- Comparison of average returns and risk

After deriving, he wants to visually explore the values of indices and daily rates of returns, followed by examination of the stationarity of the data series